Palm oil prices strengthen at the end of November

1 RM (Malaysian Ringgit) = 0.22 USD

1 USD = 0.79 GBP

*Exchange rates calculated and market prices reported on December 3, 2024

Crude Palm Oil

Average World Bank November Palm Oil Price

US$1,169/tonne (+US$92)

Malaysia palm market

After rising rapidly in the second half of November, the Malaysia CPO Settlement price slipped in the second half of the month before rising again. The peak price for the month was RM5,193/tonne (US$1,142) on the 11th November, which was the highest value for two and a half years. The average price for the whole of the month was RM4,912/tonne (US$1,081), up 12.5% more on the October figure and 36.8% more than in November 2023.

Prices slipped in the third week of the month, hitting a November low of RM4,633/tonne (US$1,019) on the 22nd. The price then gradually rose breaking the RM5,000/tonne (US$1,100) mark on the last trading day of the month on the 29th November. The final price for the month was RM5,021/tonne (US$1,105), which was 3.5% up on the month and 29.3% more than the all-time high in April 2022.

Prices were given support at the beginning of December by floods in Malaysia and the raising of the Indonesian palm oil export tax and levy. Cargo surveyor Intertek Testing calculates that Malaysia’s palm oil exports were down 9.3%, with independent inspection company AmSpec Agri estimating a 10.4% drop in trade, shows reporting by Reuters. See more here

Malaysia CPO Settlement Price RM

Vegetable oil

Small drop in oilseed production

In its most recent global vegetable oil report, the USDA’s forecast for 2024/25 was:

“The global oilseeds production forecast is down over 5.1 million tons to 682.2 million this month on lower U.S. soybeans and Sudan peanuts. Oilseeds trade lowered over 200,000 tons to 207.4 million tons as declines in U.S. soybean exports were not offset by higher Brazil soybean exports. Oilseeds ending stocks are lowered by almost 3.2 million tons on reduced U.S., Brazil, and Argentina soybean stocks. Global crush is decreased by over 800,000 tons to 556.9 million tons on lower U.S. soybean crush and Turkey sunflowerseed crush, not offset by higher Pakistan soybean crush. Global meal trade is down over 100,000 tons to 106.1 million tons on lower European Union rapeseed meal exports and U.S. soybean meal exports. Global vegetable oil trade is up over 100,000 tons to 86.7 million tons on increased Argentina soybean oil and European Union and Tunisia olive oil trade, not offset by lower Belarus and European Union rapeseed oil exports.”

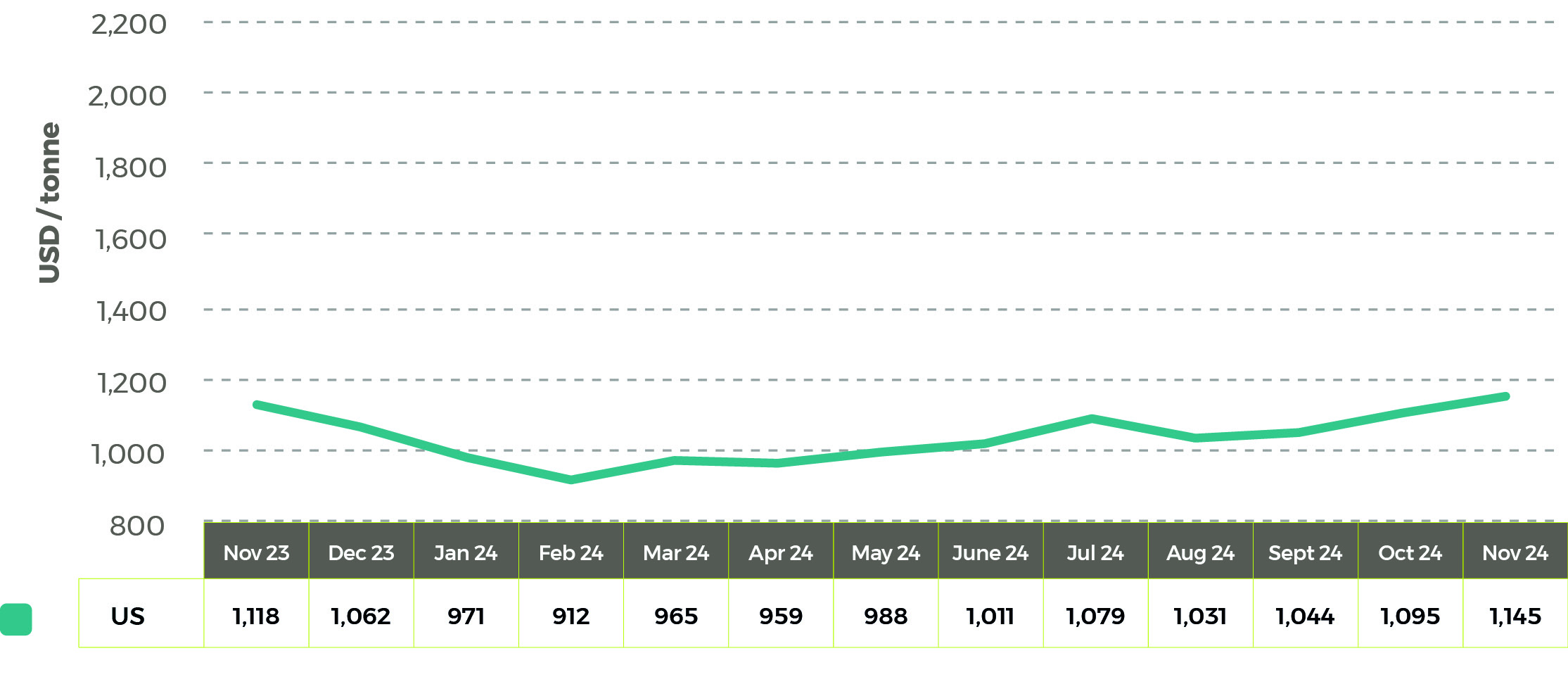

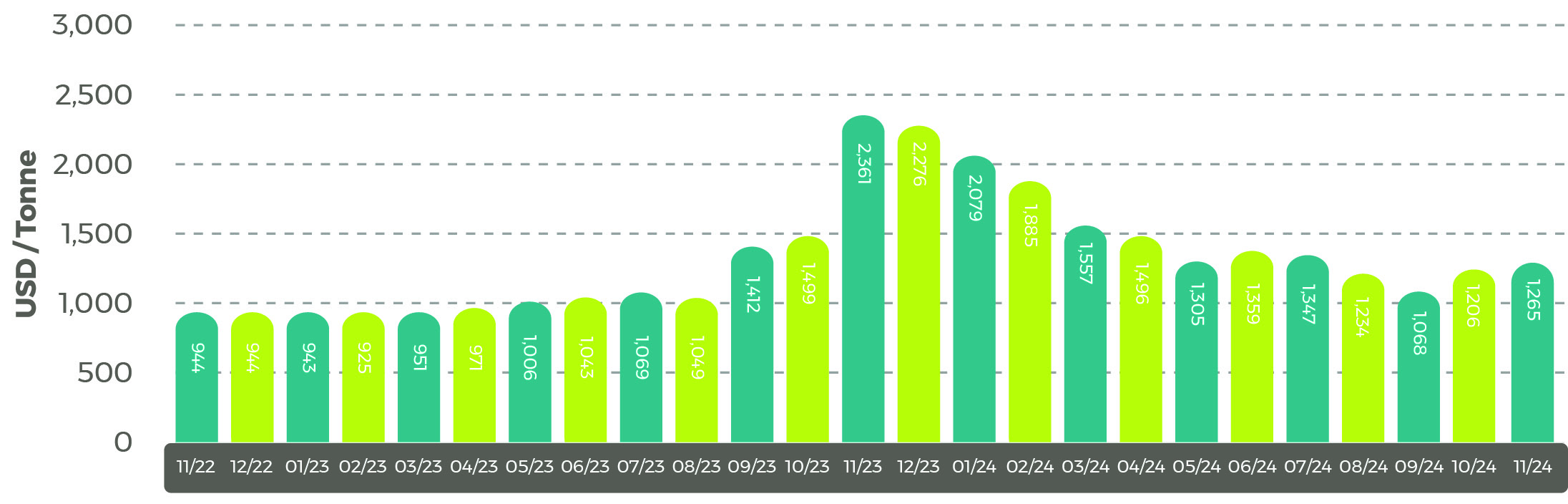

Vegetable oil prices rose in November, with palm oil increases stronger than others. Average palm oil prices rose by 8.5% to US$1,734/tonne, according to the World Bank, with a 23.2% increase in palm kernel oil to US$2,015/tonne. The rapeseed oil price was up 8.1% in the month to US$1,234/tonne, with a 4.9% increase in the sunflower oil price to US$1,265/tonne and a 4.6% increase in soybean oil prices to US$1,145/tonne. The only vegetable oil to show a decline was groundnut oil, which slipped by 0.9% to US$1,734/tonne.

Average world soybean oil prices in US$/tonne

Rapeseed oil

Average world rapeseed oil price in US$/tonne Sunflower oil

Sunflower oil

Average world sunflower oil prices in US$/tonne

Shipping Update

Shipping costs ease during November

Shipping costs have fallen through much of November after a small increase in October. Drewry’s World Container Index stood at US$3,331 per 40-foot container in its weekly report on the 28th November. That was a 2% drop on the week, but 3.7% higher than it was the month before. In July the index stood at US$5,937, 78.2% more than where it was in the most recent report. The current cost is 127% more than it was a year ago.

During November costs on the Shanghai to Rotterdam, Shanghai to Genoa and Shanghai to New York trade routes held steady but fell on the Shanghai to Los Angeles route.

From the 28th November 2024 Drewry World Container Index report:

- The Drewry WCI composite index decreased 2% to $3,331 per feu, which is 68% below the previous pandemic peak of $10,377 in September 2021 but 134% more than the average $1,420 in 2019 (pre-pandemic).

- The average YTD composite index is $3,966 per feu, which is $1,116 higher than the 10-year average of $2,850 (inflated by the exceptional 2020-22 Covid period).

Freight rates from Shanghai to Los Angeles decreased 5% or $238 to $4,250 per feu and those from Shanghai to Rotterdam fell 2% or $74 to $3,997 per feu. Likewise, rates from Shanghai to Genoa, Shanghai to New York and New York to Rotterdam shrank 1% to $4,490, $5,182 and $789 per feu, respectively. Meanwhile, rates from Rotterdam to Shanghai, Los Angeles to Shanghai and Rotterdam to New York remained stable. Drewry expects spot rates to remain stable next week.

Source: Drewry Supply Chain Advisors

View Drewry shipping data here.

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.