Palm oil prices fall throughout December, but could rise again

1 RM (Malaysian Ringgit) = 0.23 USD

1 USD = 0.80 GBP

*Exchange rates calculated and market prices reported on February 4, 2025

Crude Palm Oil

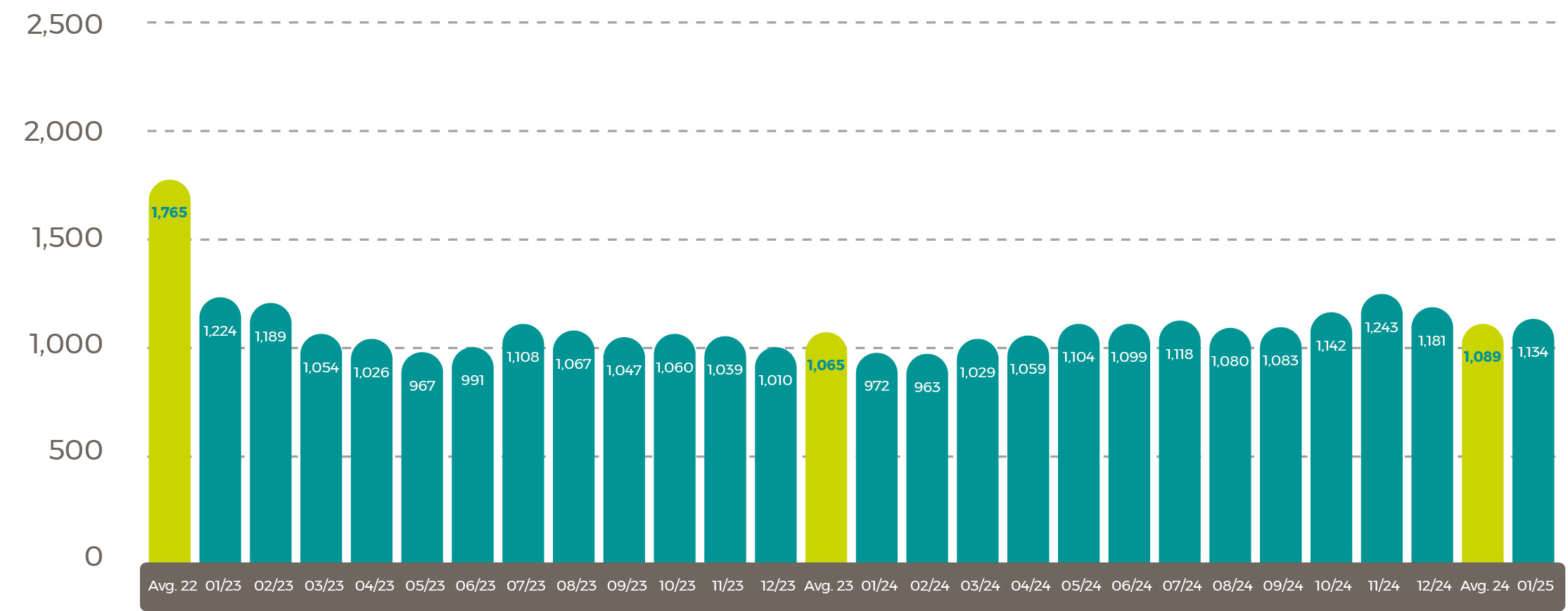

Average World Bank 2024 palm oil price

US$963/tonne (+US$77)

Malaysia palm market

Other oils boost early February values

After falling for most of January, Malaysian CPO Palm Oil Settlement Prices rose at the end of the month and into February.

The price began in January at RM4,442/tonne (US$1,022) before falling to RM4,180/tonne (US$961) on the 17th of the month. Prices then started to increase, reaching RM4,286/tonne (US$986) by the end of the month. Values then rose above RM4,400 (US$1,012) on the first day of February trading. The latest price of RM4,304/tonne (US$990) was 3.3% less than the month before, 13.3% more than a year ago, but 39.4% less than the all-time high value in April 2022.

At the turn of the month, palm oil prices were supported by higher soy oil prices on the Chicago markets and stronger crude oil prices, amid threats of a growing trade war between the US, Canada, Mexico, China and the EU.

Malaysia CPO Settlement Price RM

Vegetable oil

Small drop in oilseed production

In its most recent global vegetable oil report, the USDA’s forecast for 2024/25 was:

“The global oilseeds production forecast is down 3.0 million tons to 680.4 million this month on lower U.S. soybean, and India and Russia rapeseed, not offset by an increase in China cottonseed production. Oilseeds trade remains unchanged at 207.3 million tons, with higher Canada rapeseed exports offsetting lower rapeseed exports by Australia, Ukraine, and Uruguay. Oilseeds ending stocks are lowered 2.9 million tons to 144.3 million on lower U.S. and Brazil soybean stocks despite higher China rapeseed ending stocks. Global crush is raised over 2.0 million tons to 560.3 million on higher Brazil soybean crush and the addition of the Iraq soybean balance sheet. Global meal trade is up over 300,000 tons to 107.4 million on higher Brazil soybean meal exports despite lower Russia rapeseed meal exports. Global vegetable oil trade is up slightly to 86.4 million tons with higher U.S. soybean oil and Russia sunflowerseed oil, not offset by lower Russia rapeseed oil exports. The projected U.S. season-average farm price for soybeans is unchanged at $10.20 per bushel.”

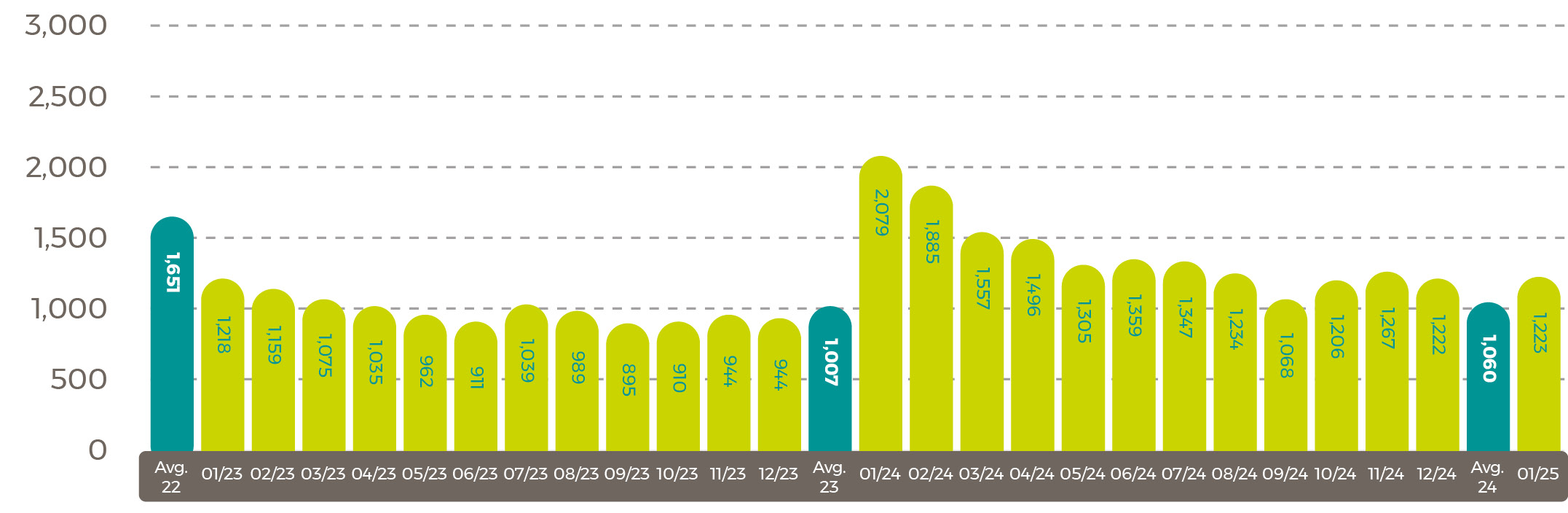

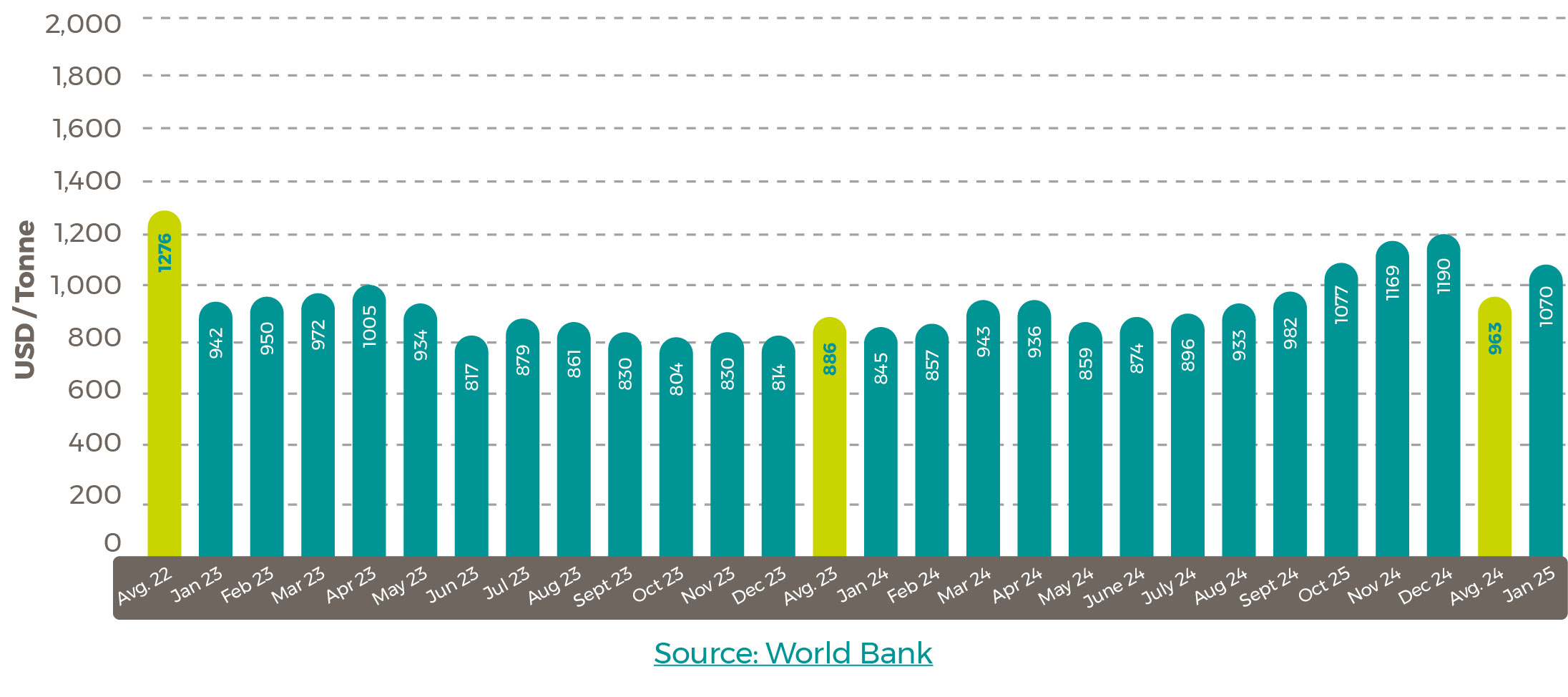

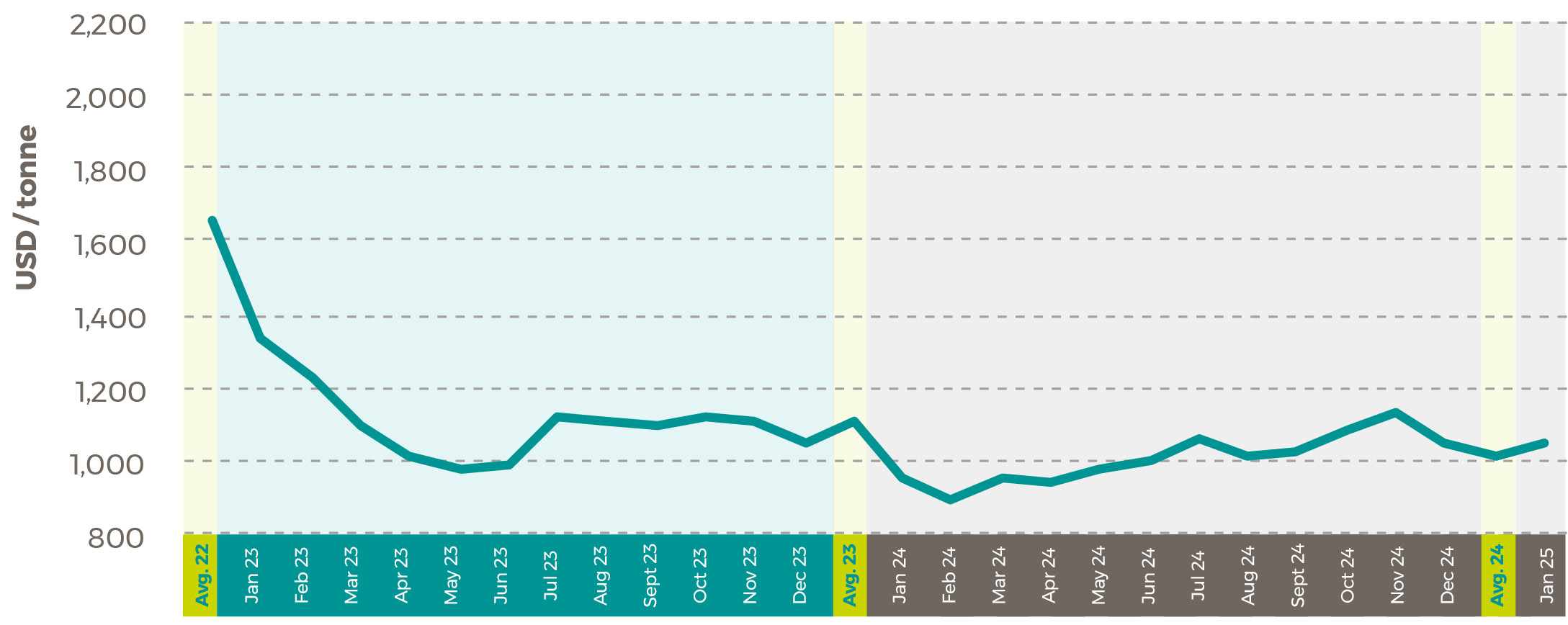

Average global palm oil prices in January were 10.0% less than the December figure at US$1070/tonne, according to the World Bank. That price was 26.7% more than the year before. Soybean oil prices fell 0.2% on the month to US$1061/tonne, which was 9.2% more than the year before. Meanwhile, rapeseed oil prices fell 4.0% between December and January to US$1134/tonne, with a 16.7% increase over the year. Sunflower oil prices rose by 29.7% over the 12-month period to US$1223/tonne, a 0.1% increase on the month.

Average world soybean oil prices in US$/tonne

Rapeseed oil

Average world rapeseed oil price in US$/tonne

Sunflower oil

Average world sunflower oil prices in US$/tonne

Shipping Update

Shipping costs ease

After rising in the last few weeks of 2024, shipping costs have fallen significantly in January. The Drewry World Container Index was US$3,364 per 40-foot container on the 30th of January. That was 2% down on the week before and 14% lower than the week before. The biggest drop in shipping costs was the fastest on the Shanghai to Rotterdam route. The current cost is 11% less than a year ago and 43% below the July 2024 peak.

From the 30th January 2025 Drewry World Container Index report:

- The Drewry WCI composite index decreased 2% to $3,364 per 40ft container, 68% below the previous pandemic peak of $10,377 in September 2021, but was 137% higher than the average $1,420 in 2019 (pre-pandemic).

- The average YTD composite index is $3,711 per 40ft container, $835 higher than the 10-year average of $2,876 (inflated by the exceptional 2020-22 Covid period).

- Freight rates from Shanghai to Rotterdam decreased 5% or $160 to $3,274 per 40ft container, while those from Shanghai to Genoa fell 4% or $162 to $4,400 per 40ft container. Similarly, rates from Rotterdam to New York reduced 2% or $46 to $2,732 per 40ft container followed by rates from Shanghai to New York and Shanghai to Los Angeles, which decreased 1% to $6,288 and $4,771 per 40ft container, respectively. Conversely, spot rates from New York to Rotterdam increased 2% or $18 to $839 per 40ft container and rates from Rotterdam to Shanghai rose 1% or $3 to $518 per 40ft container. Meanwhile, rates from Los Angeles to Shanghai remained stable. Drewry expects spot rates to decrease slightly in the coming week due to the increase in capacity.

Source: Drewry Supply Chain Advisors

View Drewry shipping data here.

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.