Palm oil prices at highest for more than two years

1 RM (Malaysian Ringgit) = 0.23 USD

1 USD = 0.77 GBP

*Exchange rates calculated and market prices reported on November 4 2024

Crude Palm Oil

Average World Bank August Palm Oil Price

US$1077/tonne (+US$95)

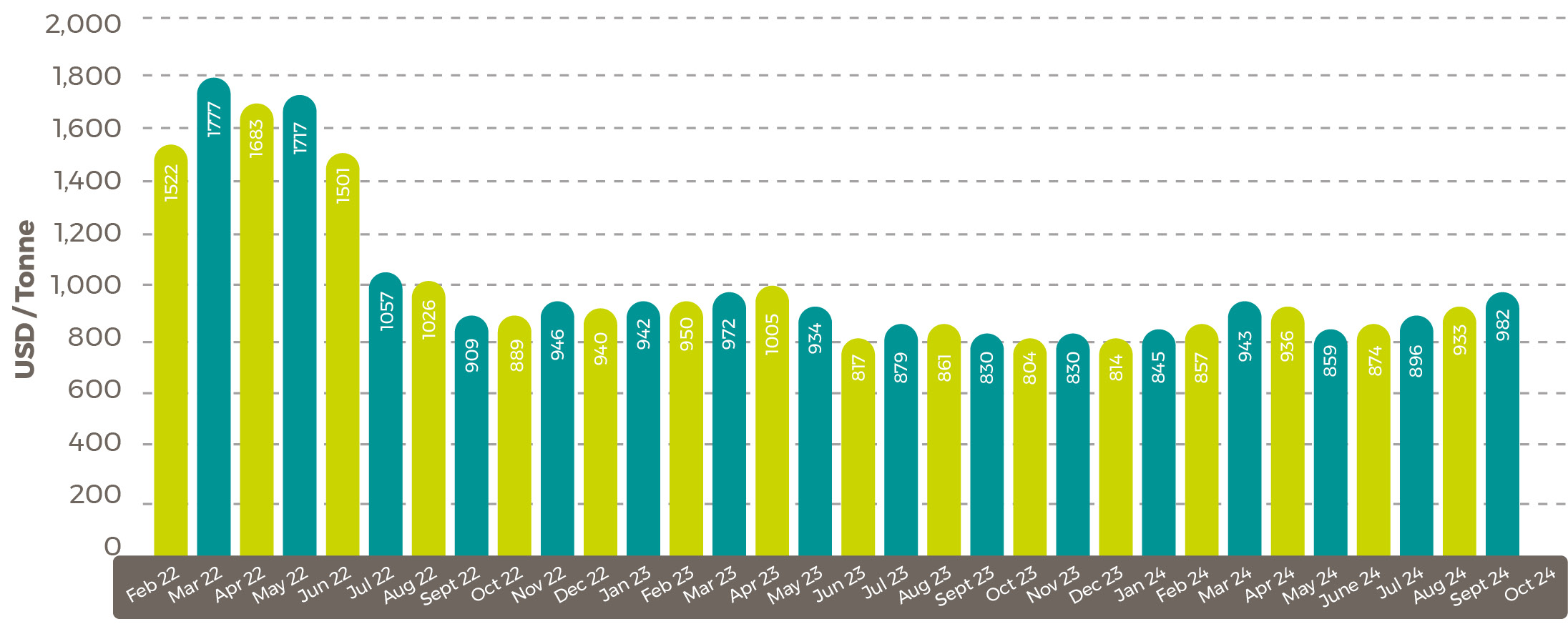

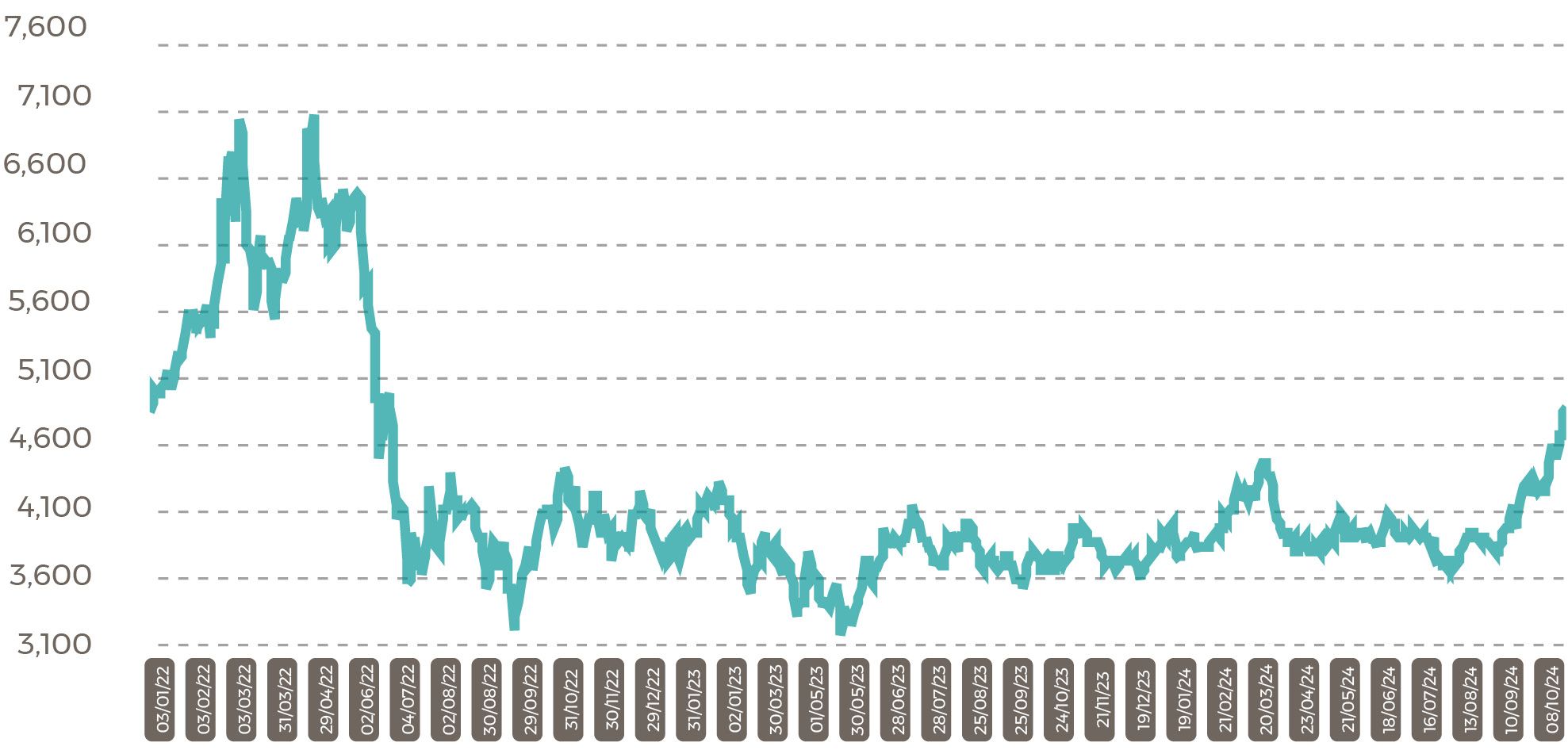

Malaysia palm market

There was a rapid rise in the Malaysia COP Settlement throughout October and into November. By early November the price was almost at RM5,000/tonne (US$1,150). If it breaks that barrier it will be the first time since June 2022. The price for the whole of the month was RM4,367/tonne (US$1,004), which was 11.3% up on September and 18.1% on the average for October 2023.

Prices sped up from the middle of the month when they were at RM4,260/tonne (US$980). By the end of the month, they had reached RM4,690/tonne (US$1,079) and had added more than RM200 (US$46) by the 4th of November. The final October price was 24.5% higher than the year before, but still 33.9% less than the all-time high in April 2022.

A weaker Malaysian Ringgit boosted values, but most support came from higher alternative vegetable oil and crude oil prices, reports Bloomberg. October palm oil exports from Malaysia were up by at least 11% suggesting greater global demand for all types of vegetable oil, reports Bloomberg.

Malaysia CPO Settlement Price RM

Vegetable oil

Small drop in oilseed production

In its most recent global vegetable oil report, the USDA’s forecast for 2024/25 was:

“The global oilseeds production forecast is slightly down to 687.3 million this month on lower U.S. and Ukraine soybeans, not offset by higher Argentina sunflowerseed and China cottonseed. Oilseeds trade is down slightly as lower Ukraine soybeans and U.S. peanuts were not offset by higher rapeseed exports from Canada. Oilseeds ending stocks are forecast over 200,000 tons lower on reduced Canada and EU rapeseed. Global crush is increased by almost 400,000 to nearly 557.7 million tons on greater China rapeseed and EU sunflowerseed utilization, not offset by lower Thailand soybean crush. Global meal trade is up slightly on higher sunflowerseed meal trade. Global vegetable oil trade is down over 700,000 tons on lower Indonesia palm oil trade, not offset by higher Thailand palm oil exports. The projected U.S. season-average farm price for soybeans is unchanged at $10.80 per bushel.”

The latest World Bank price forecast is for average palm oil prices of US$925/tonne for the whole of 2024, falling to US$860/tonne in 2025 and US$850/tonne in 2026. Less of a drop is predicted in other vegetable oils. Soybean oil is forecast to average US$1,030/tonne this year, US$1,020/tonne next year and US$1,053/tonne in 2026. Groundnut oil is forecast to be US$1,460/tonne in 2024, US$1,550/tonne in 2023 and US$1,400/tonne in 2026.

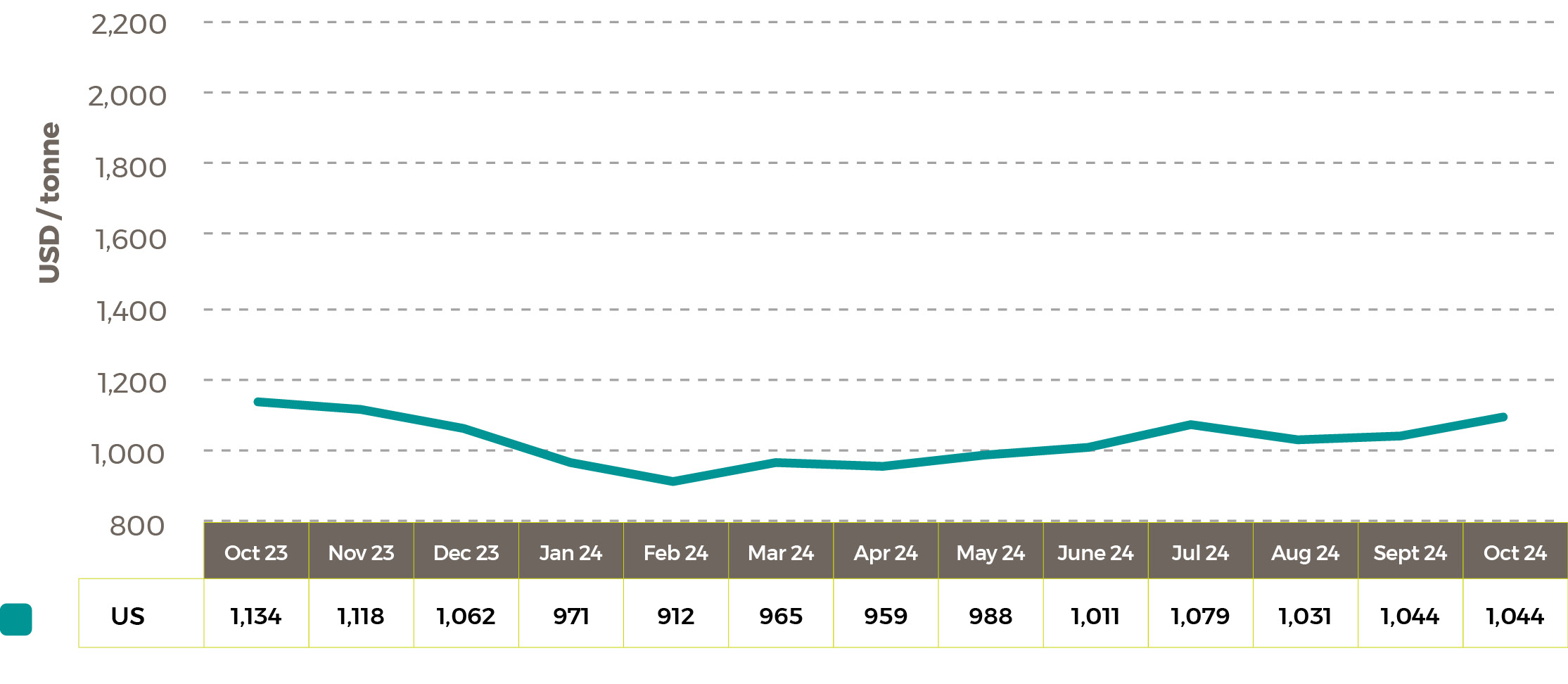

During October soybean oil prices rose 4.9% to US$1,095/tonne, according to the World Bank. Rapeseed oil prices were up 5.4% to US$1,142/tonne and sunflower oil gained 12.9% to US$1,206/tonne.

Average world soybean oil prices in US$/tonne

Rapeseed oil

Average world rapeseed oil price in US$/tonne Sunflower oil

Sunflower oil

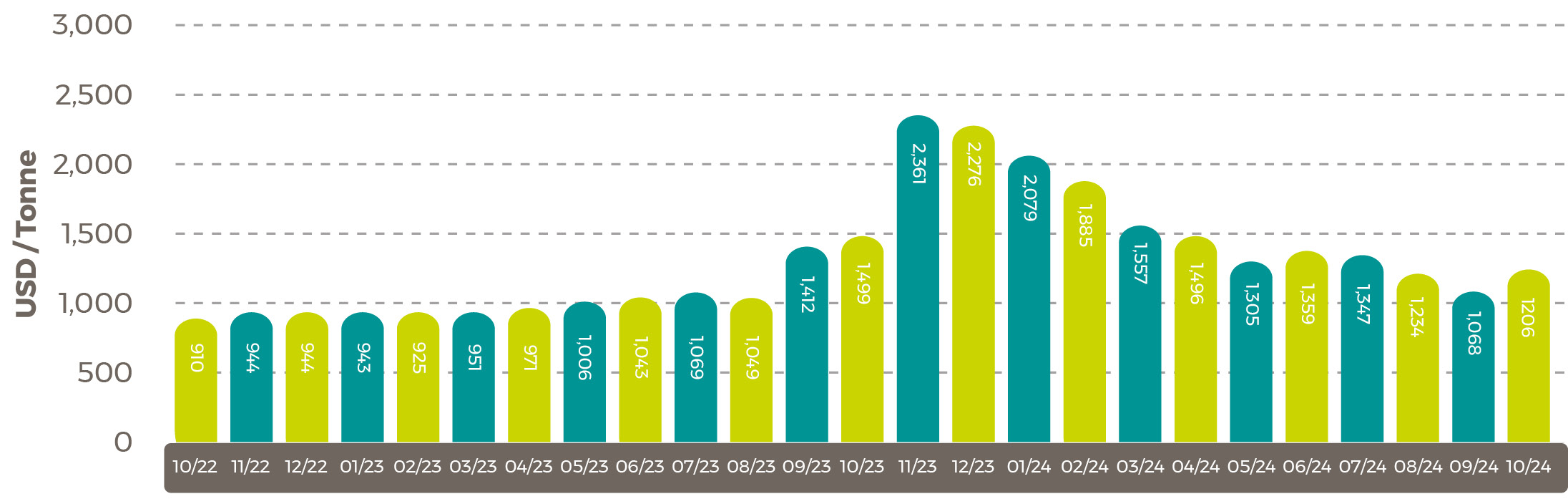

Average world sunflower oil prices in US$/tonne

Shipping Update

Small rise in shipping costs at the end of October after a sharp drop

The decline in shipping costs that began in July continued throughout most of October but did show signs of ticking up again at the end of the month. In its report of 31st October, Drewry said its shipping index was US$3,213 per 40-foot container. That was an increase of 4% on the week.

The latest cost was 45.9% less than the July peak, but still 135% more than the year before. Costs on the Shanghai to Rotterdam and Shanghai to Los Angeles routes continued to fall, but there was a small rise in costs on the Shanghai to Genoa and Shanghai to New York routes.

From the 31st October 2024 Drewry World Container Index report:

- The Drewry WCI composite index increased 4% to $3,213 per feu, which is 69% below the previous pandemic peak of $10,377 in September 2021 but 126% more than the average 2019 (pre-pandemic) of $1,420.

- The average YTD composite index is $4,017 per feu, which is $1,178 higher than the 10-year average of $2,839 (inflated by the exceptional 2020-22 Covid period).

- Freight rates from Shanghai to Genoa skyrocketed 11% or $352 to $3,648 per feu and those from Shanghai to Rotterdam increased 8% or $264 to $3,396 per feu. Rates from Shanghai to Los Angeles and Los Angeles to Shanghai also increased 1% to $4,839 and $718 per feu, respectively, whereas those from Rotterdam to Shanghai decreased 1% or $5 to $543 per feu. Meanwhile, rates from Shanghai to New York, New York to Rotterdam and Rotterdam to New York remained stable. After a decline since August, spot rates ex-China increased this week, and we expect this trend to continue as the Christmas rush intensifies.

Source: Drewry Supply Chain Advisors

View Drewry shipping data here.

Disclaimer: The information in this document has been obtained from or based upon sources believed to be reliable and accurate at the time of writing. The document should be for information purposes only and is not guaranteed to be accurate or complete.